Targeted health and self-help fund taxation 2024

A couple of years ago, the following were considered the top employment benefits thanks to their favourable taxation or their tax exemption:

- cash employment benefits

- home loan repayment

- Erzsébet voucher

- school starting aid

- health insurance.

However, due to the year-on-year changes within the employment benefits pallet, these items are not available, but fortunately, they can still be used through the self-help and health fund with extremely favorable taxation.

With a targeted self-help fund service, home loan repayment, school start, and health insurance policies financing the service can also be replaced as a targeted health fund service.

How are the targeted health and self-help fund services taxed?

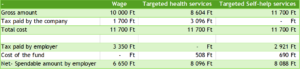

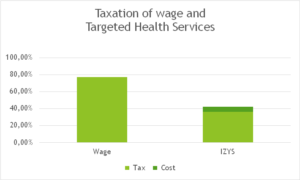

As shown in the table above, whichever version the employer chooses, they are guaranteed a better outcome than if they were to pay traditionally. In the case of support for targeted self-help fund services, only about one-third of the wage bill will have to be paid by the employee, in the case of support for health-fund services, less than half will be the tax payable by the company. All this legally, according to rules set out in legislation.

What services are part of the health and self-help Fund’s services?

Apart from the taxation aspects, it is also important what the employees spend their money on. In vain do we want to give someone a home loan repayment installment if they just need to cover their drug expenses. In the following links we depict which targeted support allows which services to be used.

Companies can contract for both grants and make it optional for their employees which employment benefit framework they want to direct their money to.

You have questions unanswered? Contact us!

Our colleagues, between 8:00 – 16:30, are available to answer any further questions on the

+36 1 769 0061 phone number.