Targeted self-help fund services 2026

We offer targeted services since 2016.

Until January 1, 2019, the employer’s contribution was taxed at the same rate, so it did not make sense for employers to replace this well-proven benefit.

From 1 January 2019, the employer’s contribution is taxed at the same rate as the wage. Thus, it lost its tax advantage over the benefit provided for the targeted self-help fund service, which remained tax- and contribution-free with the employer.

With the reduction of the social contribution tax to be paid by employees, the taxation of the benefit has become even more favorable!

Benefits of the targeted services

Apart from the favourable taxation, there are many other benefits of the self-help fund’s targeted services, looking at it from the perspective of the employer’s contribution. One of its biggest advantages is that you are not obligated to provide this for all of your employees, you can narrow down the circle of people that can benefit from the services. (e.g. if the worker was on sick leave for more than x days in the given month, they are not entitled to it or is only given to clerical workers, those close to retirement, family founders, etc.)

The amount paid as a targeted service is credited to a community fund maintained for the employer. So the Fund handles it separately for each employer. From the segregated account, members can use the service as long as financial coverage is available.

It is not required to provide an equal amount of money for each employee. Furthermore, you can determine the amount that each employee is authorized to use in the form of a percentage or an exact amount.

Further benefits can include the amount being paid by the employer may be recalled by the employer, if the contract so requires, but may also provide that the member may use the amount received from the employer even if, for example, they no longer work for the employer.

The following targeted services are provided by the IZYS Health and Self-help Fund:

- Home loan repayment

- Child birth or adoption

- Kindergarten

- Schooling

- College and university

- Child benefit addition

- Housing utility charges

- Placement in nursing homes

- Funeral expenses

- Unemployment

The XCVI of 1993. Pursuant to Section 50 (1) – (2) and Section 12 / A (5) of the Act, targeted self-help fund services do not qualify as individual services, therefore the services are paid for without a waiting time; there is no need to wait 180 days!

The employee is not liable to pay tax on the amounts credited to the fund account as targeted self-help fund support.

The money withdrawn from the fund account, which was based on the subsidy paid for targeted self-help fund services, is taxed at the member as other income meaning, the member is only liable to pay tax when the Fund’s service has been credited to their bank account, but must pay the tax and contribution in the year following the preparation of the tax return, ie not monthly.

In the case of the targeted service, the Articles of Association and the Settlement and Service Regulations have to be taken into account. where the services are listed, by clicking on each link, you can find out the number and conditions under which employees can account for their money.

Taxation of other income from January 1, 2026

Taxes payable by employees:

- Personal income tax: 15% of 89% of the amount withdrawn from the cash account = targeted service x 13.35%

- Social contribution tax: 13% of 89% of the amount withdrawn from the cash account = targeted service x 11.57%

Meaning the deduction for the individual is only 24.92%

It is very important to note that it is not the amount received from the fund and amount on your account, but rather the amount spent/taken out/transferred from your account that you must pay tax after. Advantages of this:

- If the employee does not spend the benefit in the given year, a zero forint tax liability arises for the tax year!

- In the case of a self-help targeted benefit, the tax is payable only on the benefit actually received, as opposed to the health fund targeted benefit, where the company also has to pay a tax of 37.76% on fund expenses.

- Another advantage is that the tax on the amount spent / withdrawn / transferred does not have to be declared and paid by the member when earning the income, but only when preparing the annual tax return. Thus, in practice, the government also provides an interest-free loan for the payment of taxes.

- You don’t have to worry about your employees not being able to pay the burden. If the employee is unable to pay the taxes in a lump sum at the time of the tax return, they can simply request an interest-free installment payment from National Tax and Customs (NTC) for six months by placing an X on the return!

- If for any reason, the fund returns the self-help fund benefit, the company is released from all tax obligations related to the benefit.

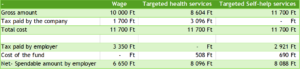

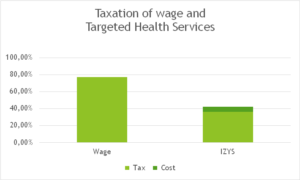

Summary table on the Funds’s targeted services’ expenses and taxation

Whichever targeted service you want to give or make available to employees, roughly half of the traditional wage burden is less than the tax payable on targeted benefits.

The process of concluding the contract

The employer must enter targeted self-help fund service contract with the Fund.

Employees who receive the benefit must become members of the fund if they are not already. To become a member you must complete the entry form which you can do on paper or online. (After filling it in, you will receive it by e-mail in pdf format. It must be sent in print and signed.)

In the case of mass entry, we fill in the entry forms if we receive the employees’ data in an excel template. The template can be requested from our colleagues through the ugyfelszolgalat@izys.hu email address.

Payment and declaration

Simultaneously with the start of the transfers, the employees’ names, tax identification, or member identification number as well as the amount of the benefit must be sent to one of these two email addresses: penzugy@izys.hu or adatszolgaltatas@izys.hu. The excel spreadsheet you can fill out with the data can be found here.

Fund costs

In the case of the targeted self-help fund service, 94.1% of the employer’s payment will be available to employees.

Who can benefit from targeted services?

- fund members that are employed by the same employer,

- members of the fund who choose the form of self-help fund from the optional fringe benefits,

- fund members with an advocacy body, a social organization, an association, a works council, a certified membership or a board member,

- members of the same age,

- the number of fund members holding the same position or holding the same position with the same employer,

- the number of members of the fund who are employed by the same employer and who have been employed by the employer for a period specified by the sponsor,

- the number of fund members employed by the same employer who make their own contribution higher than the amount indicated by the sponsor in the given calendar year,

- members of the fund who are members of the company with the same legal person or unincorporated legal personality,

- members domiciled within a specific administrative boundary,

- a member receiving a benefit specified by the sponsor from among the benefits provided under the welfare and social benefits scheme, the optional fringe benefits or the cafeteria scheme in the sponsor’s collective agreement or equivalent regulations,

- all fee-paying Fund Members,

- Fund Members with the same duration of employment,

- members with the same qualifications,

- members with the same type of employment contract,

- new members,

- fund members belonging to the same group of employees of the same employer,

- members with disabilities, such as invalidity, accident disability pensioners,

- members of the fund employed by an employer or having a membership relationship with the donor, or a group of members defined by the sponsor (for example, occupation, job, etc.),

- fund members with other (assignment, business) legal relations to work with the same employer,

- fund members using the same fund service,

- members taking the same medicine or using the same medical device,

- members reaching retirement age within the time limit set by the sponsor,

- fund members of a profession, sector, organization,

- members who pay a membership fee higher than a certain amount in a given calendar year,

- members of the department or a group defined by the sponsor,

- the supporting Civil Code. fund members who are not close relatives within the meaning of

- fund members who have a long-term legal relationship with the sponsor or have entered into an ad hoc agreement (even with implied conduct) with the sponsor to perform the services specified by the sponsor,

- members affected by the termination of employment by the same employer or a group defined by the sponsor,

- members of the department or group (s) identified by the sponsor,

- a group of people in the same social, family, social situation (for example, a group of persons determined on the basis of the number of children, large families, those on maternity leave, those in GYES, GYED, those below a certain income level, etc.).

Other useful information

Targeted self-help fund services

You have unanswered questions? Contact us!

Our colleagues are available on workdays between 8:00 – 16:30 on the +36 1 769 0061 phone number.