Tax credit return

Every working individual pays a personal income tax. Fortunately, it is possible for everyone to gain a tax return in the form of tax credit.

The self-help fund tax credit is available to everyone, regardless of their income limit, who thinks responsibly about their life and future and that of their families.

We can choose to use our recovered tax immediately to accomplish our family or health-related goals, or rather save it and bleed it free of interest tax so that even more money is available later when we need it.

Another advantage for long-term thinkers is that 10% of the amount pledged in the 2-year deposit is also returned in the form of tax credit, so we can get 30% instead of a 20% return.

Anyone who hasn’t heard of the tax credit return may ask how it works.

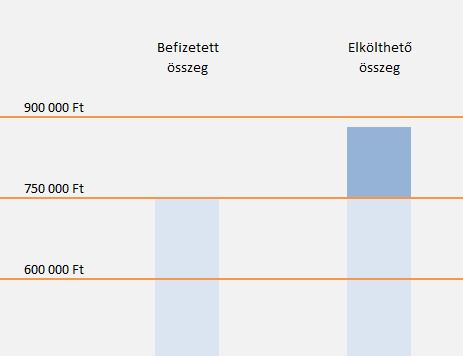

According to the current legislation, 20% of the amount paid to the self-help fund can be reclaimed in the form of a tax credit return. The return is credited to the fund member’s account and can be used at any time without a time limit.

Fortunately, we do not have to give up the amount we paid into our account for a long time either, because we can spend it on many different health services such as medicine, respiratory monitors, medical mattresses, or any family service from the 180th day after payment. This is important because it is good to know that the tax credit depends only on the amount of the payment ie. spending the amount does not affect your entitlement to the tax credit return.

Many consider it important to donate 1% of their tax to a church or non-profit organisation. With the self-help fund payments you can claim back 20% of the amount paid as opposed to the 1% you use to support others, you can now have 20% to support yourself from your taxes. Pay into the self-help fund and use your tax to achieve your own goals.

HUF 9 is generated out of every HUF 7.5 paid through the tax credit return:

Relating page: